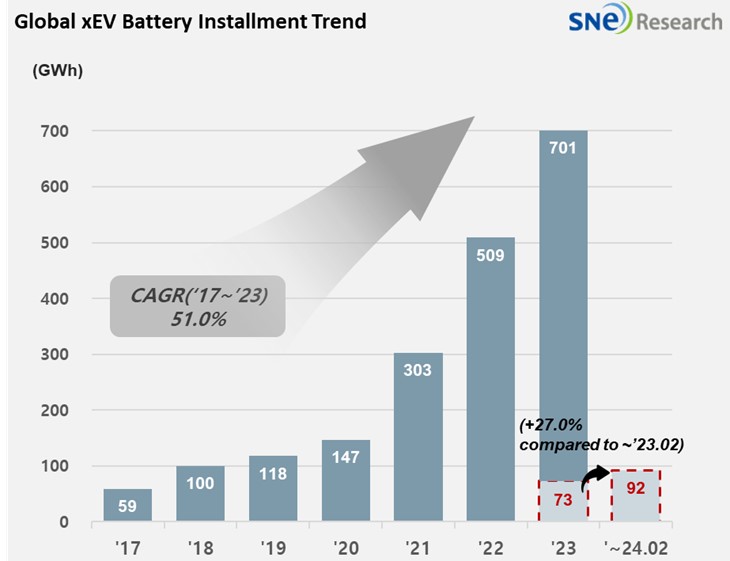

From Jan to Feb 2024, Global[1] EV Battery Usage[2] Posted 92.4GWh, a 27.0% YoY Growth

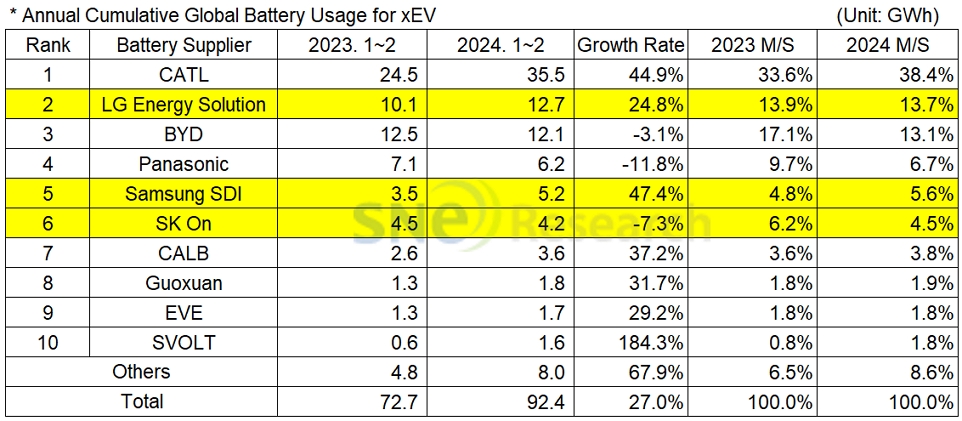

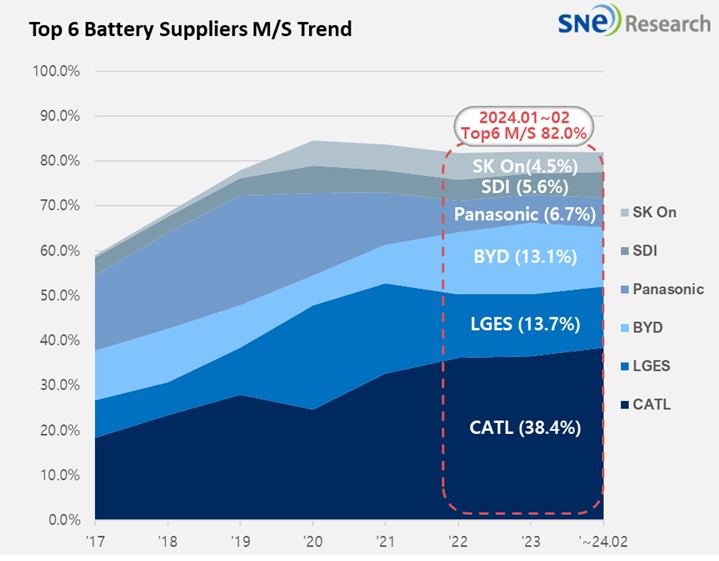

- From Jan to Feb 2024, K-trio’s M/S recorded 23.8%

From

January to February 2024, the amount of energy held by batteries for electric

vehicles (EV, PHEV, HEV) registered worldwide was approximately 92.4GWh, a 27.0%

YoY growth.

(Source: 2024 March Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares of K-trio companies were 23.8%, declined by 1.2%p compared to the same period of last year. LG Energy Solution ranked 2nd with a 24.8%(12.7GWh) YoY growth, while Samsung SDI posted the highest growth of 47.4%(5.2GWh) of the K-trio companies. On the other hand, SK On showed a degrowth of -7.3%(4.2GWh).

(Source: 2024 March Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look the usage of battery made by the K-trio, Samsung SDI continued to be in an upward trend thanks to solid sales of BMW i4/5/7 and Audi PHEV in Europe as well as high sales of Rivian R1T/R1S/EDV in North America. Samsung SDI, which has been targeting the premium EV battery market, marked a rapid growth based on its high-value-added battery P5. As it is reported that Samsung SDI is soon to start mass production of P6, of which energy density is improved by over 10%, for customers in the US region, it is expected to see a sales increase in the premium EV battery market.

SK On saw its battery usage similar to that of the same period of last year, but recorded a degrowth due to slow sales of Hyundai IONIQ 5 and KIA EV 6. However, as the Mercedes EQ line-ups have been sold favorably and the global sales of KIA EV 9 has expanded, SK On is expected to turn to an upward trend again. In addition, it is reported that SK On is going to supply its battery to new models released by Hyundai Motors next year as the battery maker signed a supply contract worth of 590 GWh with Hyundai. Furthermore, it is also reported that SK On was selected as a battery supplier to a Nissan vehicle to be launched in the US market, leading to an anticipation that SK On would target the European and North American markets in future.

LG Energy Solution’s growth was led by sales of highly popular vehicle models in Europe and North America such as Tesla Model 3/Y, Ford Mustang Mach-E, and GM Lyriq. On top of growing uncertainties in the market about a slowdown in electric vehicle demand, tensions have been rising as it is reported that CATL has been negotiating with GM to license its LFP battery technology and build a joint factory. However, as the production volume from Ultium Cells 2nd factory has increased and a new model from GM with the Ultium Platform is applied is scheduled to be released, LG Energy Solution is expected to lead the North American market with its ternary battery meeting the IRA regulations.

Panasonic, the only Japanese company in the top 10 on the list, recorded 6.2GWh from Jan to Feb this year and ranked 4th on the list, but it posted a 11.8% YoY degrowth. Panasonic, one of the major battery suppliers to Tesla, has most of its battery usage installed in Tesla Model Y in the North American market. As Panasonic is reported to unveil its advanced 2170 and 4680 cells, it is expected to expand its market share mostly focusing on Tesla.

CATL firmly captured its global No. 1 position with a 44.9%(35.5GWh) YoY growth. CATL was the only battery maker taking up a market share over 30% by supplying its battery to major brand vehicles such as ZEEKR and Ideal, in the Chinese domestic market, regarded as the world’s biggest EV market, and also to vehicles of global major OEMs such as Tesla Model 3/Y, BMW iX, Mercedes EQ Series, and VW ID Series.

BYD, a strong player in the Chinese domestic market, saw a sudden drop in its EV sales due to the influence of Chinese New Year holidays. It took the 3rd position in the global ranking with a 3.1%(12.1GWh) degrowth. BYD sold the most electric vehicles in the China market based on its price competitiveness through vertical SCM integration such as in-house battery supply and vehicle manufacturing. Recently, it has been working on a full operation of production line in Thailand, helping it rapidly expanding its presence on the global stage and increase its global market share.

(Source: 2024 March Global Monthly EV and Battery Monthly Tracker, SNE Research)

As demand in the global electric vehicle market started to go through a slowdown, some of the battery makers, who’ve been enjoying the growth for quite a long period of time, began to experience a YoY degrowth in their battery usage. However, such degrowth can be viewed as temporary due to several factors: a delayed determination of subsidy offered to electric vehicles in Korea and reduced working days due to the Chinese New Year holidays consequently leading to a decline in EV sales. Later when such deferred demand for electric vehicles comes back and the electric vehicle sales rebounds, the battery usage for electric vehicles is indeed expected to recover and return to the growth trajectory

[2] Based on battery installation for xEV registered during the relevant period.